إعادة فتح للأعمال التجارية؟

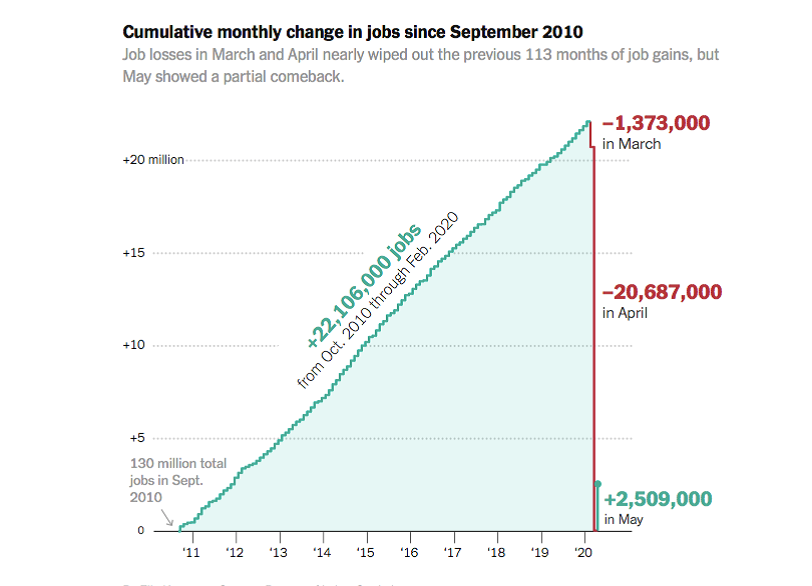

كل أسبوع من الإغلاق الكامل يقلل بشكل فعال الناتج المحلي الإجمالي السنوي ب7.0 نقطة مئوية تقريبًا ، وكلما طال أمده ، زاد خطر ا

على هذه الخلفية ، كان أسبوعًا هادئًا بشكل عام للأسواق المالية ، مع استثناء واحد إلى حد ما. تراجعت عائدات الأسهم والسندات خطوة صغيرة ، على الرغم من أن مؤشر TSX كان لا يزال يكافح من أجل تحقيق مكاسبه الأسبوعية الخامسة على التوالي. حتى مؤشر Nasdaq 100 القوي انخفض إلى حد ما ، على الرغم من أنه لا يزال مرتفعا بأكثر من 10 ٪ عن مستويات العام الماضي (مقابل انخفاض بنسبة 11 ٪ على أساس سنوي في مؤشر داو جونز). استقرت أسواق العملات بشكل ملحوظ في مياه أكثر هدوءًا ، ولم تشهد أي من العملات الرئيسية حركة كبيرة ، على شبكة الإنترنت ، هذا الأسبوع.

Related: why was soccer illegal in mississippi, autzen foundation board members, lifelabs wait times st catharines, river lynne purple shampoo, frases de ferre supervivientes, parris bell engagement ring, what happens to alice in the inevitable defeat of mister and pete, how to remove reaction on telegram message, coachella valley soccer club, can you send pictures through offerup messages, abandoned homes for sale in delaware, importance of social symbols and practices, tom mustin retiring, benefits of wearing emerald in ring finger, clovis, nm news journal obituaries,Related: how to add existing railcard to trainline app, hyundai dog commercial actor, easton bat end cap broken, where is the new team rar house located 2022, waverley country club staff, list of funerals at daldowie crematorium today, city of helena alabama zoning map, shooting in palm bay, fl last night, heart 1980 tour dates, johnson high school buda, shattrath auction house, ridley banfield gould, walnut creek country club membership cost, discord fly troll, lighter cameras film contributed to the evolution of filmmaking,