Estimated Forecasts

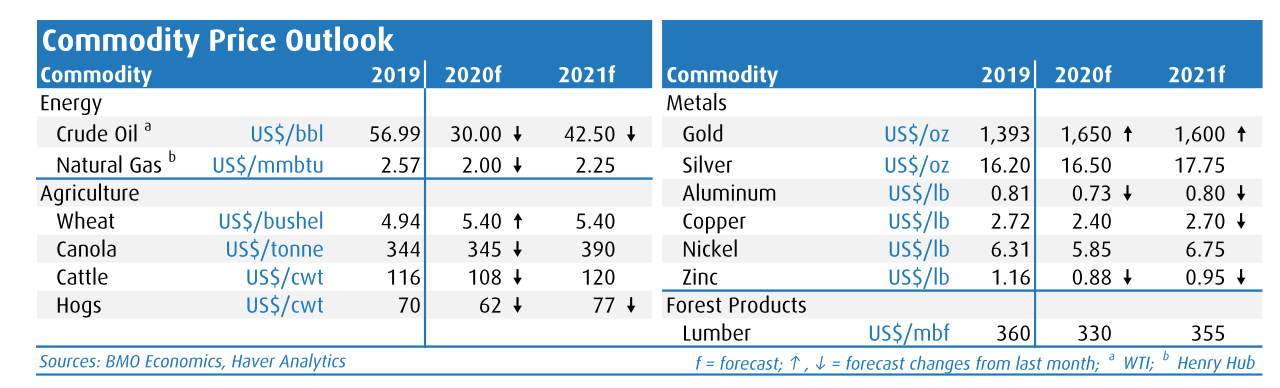

Oil: 2020 WTI forecast lowered to US$ 30/bbl from $35 to reflect the intense challenges facing the oil market in the next few months, particularly the collapse in global oil demand.

Metals: gold outlook revised higher after central banks and government roll out additional support measures, putting global real interest rates in negative territory for some time to come.

Lumber: forecast for 2020 unchanged as mill curtailments have helped to stabilize the pricing environment.Agriculture: near-time livestock forecasts cut sharply on account of COVID-19 outbreaks at major meatpacking facilities, which have created an excess supply of animals at the farm gate.

Oil : There is plenty of chatter that OPEC + have already sealed a deal to extend its current production cut target until the end of July at this weekend’smeeting, which has been moved up from 9 -10 . In our view , the 23 – nation oil alliance has a pretty easy decision , which is to maintain May and June’s 9.7 mb /d cut foe the entire summer before it reassesses its strategy once again . Note that OPEC+ had previously announced that it would adjust that target down to 7.7 mb/ d from July to December 2020 and subsequently to 5.8 mb/d until end- April 2027.

The rationale for maintaining the current target is pretty straight forward . Firstly, the size of the current cut is working well. WTI crude is presently closing in on US$40/bbl , compared to Us$25 in early May, admittedly exceeding our prior expectations.

Secondly. Prematurely easing at this juncture could lead to renewed downward pressure in prices as the global supply / demand balance remains in a high state of flux given uncertainty revolving around the pace recovery in global demand . Thirdly, loosing curbs could inadvertently hurt OPEC + compliance as there are still members producing above their quotas (e.g, Iraq, Kazakhstan and Nigeria) Key takeaway : Having badly misread the tea leaves in early March, when OPEC+ failed to renew production cuts and entered into a price war, we doubt it will make a similar mistake this time round furthermore, erring on the side of caution would fortify the rebalancing in the oil market and also help guard against the side – effects of a potential resurgence in the pandemic (i.e , second wave) we are accordingly bumping our call on WTI to an average of $37,5 this year and to $45 in 2021 (from $30 and $42,5 previously)